Although many people have heard about credit cards, there are still those who wonder what is a credit card and how can I use it intelligently? This is because there are many stories of how these cards have turned some people in to paupers. This article will answer this frequent question often asked on what a credit card is.

Basics of credits cards.

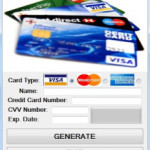

A credit card is a plastic card that has a magnetic strip and is usually found in many people’s purses and wallets. Credit cards are issued by financial institutions and are used to make purchases physically in shops or during online transactions. Credit cards can also be used to transfer money or withdraw money from an ATM.

How credit card works and what is credit card?

The holder of a credit card is given a predetermined amount of credit or loan known as credit limit. This is the maximum amount of cash one can spend using the credit card. One gets a statement showing the amount of money they have spent and the minimum amount of money they should pay by a certain date. Any time a purchase is made, the credit balance goes down by the same amount spent. If a person does not pay off the accrued balance in full, they are charged interest on the remaining amount. The more accrued balance one has, the more interest one is charged.

Benefits of using a credit card.

One can make use of a credit card all over the world, and it offers the holder ultimate convenience as he or she does not have to carry cash as they travel. With a credit card, one has instant cash to spend even if they have not worked for it. One can therefore, buy something urgent with a credit card and repay it by end month at an interest. Some credit cards offer insurance protection for example travel insurance when one is traveling. Other cards give reward points where by customers can redeem points for products or cash.

Problems associated with credit cards.

Credit cards can become problematic if the holder is not disciplined enough. If one accrues more debt than they are able to repay every month, they may incur many charges in the form of interest. This leads to a situation where a person only pays interest without reducing the actual debt. This may eventually lead a person to serious debt and bankruptcy as the interest rates continue to go up. Research has also shown that one is likely to spend more when buying on credit, as opposed to cash payment. This is because one does not feel the immediate pinch of removing money from the pocket.

It may seem particularly impressive when people swipe credit cards in shops, restaurants, hotels and other places. One should however, remember that this is a commitment and payments must be made. Lack of discipline in using these wonder cards can easily make one a pauper. Do not wonder any more about what a credit card means. All your questions should be answered by now.